Geologists, landmen, and engineers often work for an over-riding royalty interest (ORRI.) As one geologist recently told me, “If I can ever get rid of this ORRI, I’ll never sign another.” What is an “over-ride”? In lieu of a direct payment, the owner of an ORRI may elect to earn a percentage of the well. This used to mean that you got a half to perhaps one and one-half percent of the gross proceeds, either as oil placed in a tank you set, or more commonly a percentage in dollars of the gas or oil sold. In practical terms is amounted to say 1% of the gross sales based upon the price of the oil at the wellhead.

Deregulation changed all that. Oil and gas isn’t priced “at the wellhead” rather is priced at the end buyer, be it next door or a thousand miles away. The cost of transportation, compression, etc. was then deducted from that price to arrive at the “price” at the well head. Lumped into those “post-production” expenses also were likely to be maintenance of the well by a pumper, water disposal, etc. The end result was a huge amount of that 1% disappeared into the coffers of the well operator. And the ORRI was no longer a real royalty, rather an earned working interest devoid of the initial cost of actually drilling the well and paying for the leases.

This is all well and good so long as the gross sales exceeds the gross expenses. With the collapse of oil prices in 2020, suddenly even these so-called “royalties” are no long making money, rather the ORRI is billed for the expenses. Whoa! Wait a minute. Isn’t that the very definition of “economic limit”? Why are the oil companies still pumping oil if every barrel is being sold at a loss? Why don’t they shut the wells in? Aren’t they obliged to do so as a “prudent” operator?

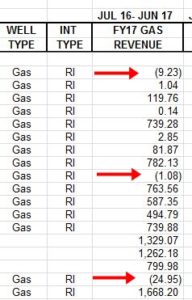

The answer is simply that the operators are trying to cash flow every dime they can to stay afloat. Then they will file bankruptcy if they have to. They are hoping to cover the current bills and wait out the market until prices improve. So the ORRI owner is left owing money for what once was totally expense free. This also means that when post-production expenses exceed the income, the mineral owner is also stuck with the bill! What? How can that happen? Well, it does happen, sometimes buried up in the check stub statement are such negative incomes. Since these may be disguised among payments from several wells, the owners often don’t even notice their income statement has a negative entry. And this has been happening well before 2020. See the date on the list below.